Incentives and Financing

Numerous documents on this site are in PDF format. In order to view them, you will need Adobe Acrobat Reader. To download the reader, click here. If you are viewing this site on a mobile device, you can download Adobe’s Reader for Mobile Devices here.

NEW IN MARCH 2022

Morrison Area Development Corporation (MADC) Programs

2021-08-01 Final Draft Fact Sheet Morrison Community Improvement Fund Programs (1)

The MADC is the economic development organization for the City of Morrison and is committed to assisting existing Morrison businesses and potential new businesses that are looking to locate in Morrison. The group has recently created new programs to help encourage future development within the city which are managed by the Morrison Community Investment Fund (MCIF) Committee. This committee is comprised of MADC board members. Below is a description of new programs and links for program applications and documents.

Opportunity Fund Grant Program

This program is open to any business in the Morrison zip code. Funds can be requested in any dollar amount up to a $5,000 maximum request.

Funds can be requested for economic development related costs or miscellaneous costs. Examples of allowable requests under each category are listed below.

Development Expenses

- Build out city services to a property (water, sewer, fiber)

- Grant for new business expenses for any new businesses locating in the City’s arts, cultural and entertainment district. (maximum value $500 – accessed one time).

- Website development expenses

Miscellaneous Expense Requests

- Paying the first year membership dues for the Morrison Chamber of Commerce for a new 61270-member business.

- Support individual requests from the Morrison Mapping Committees.

- Provide a one-time voucher for new Morrison home buyers for use on first month of city water-sewer fees (maximum allowable value $350)

- Provide one-time payment of first month rent for anyone who has obtained a degree or certificate from a post-secondary institution within six months of request date that will have a job with a Morrison company (maximum value $750 and this cannot be accessed more than once including as a couple).

2021-08-01 Final Draft MADC Opportunity Fund Request Form (2) 2021-08-01 Final Draft morrison business facade & beautification program application (2)

Business Façade and Beautification Loan Program

This program is designed to encourage investment in Morrison businesses. Funds can be requested in any dollar amount up to a $5,000 maximum request.

Eligible Expenses

- Exterior Improvements to a property owner’s or tenant’s commercial building that conforms to local design guidelines including Morrison’s Historic Preservation Commission.

- Applicants are required to provide written bids with their application.

- Program is available to any business within the 61270 zip code. All applicants must provide written bids with application. There is no financial review required to participate in this program.

- Program is a 50% Matching Funds Program with repayment of funds up to three years at 0% interest to allow for reinvestment in additional properties. Loan must be repaid in full prior to submitting an additional request for funds.

- There is a $100 application fee payable to MADC if loan is approved.

*Note: This can be dovetailed with Morrison’s Building Improvement Program for those businesses located in the historic district.

2021-08-01 Final Draft morrison business facade & beautification program application (2)

Revolving Loan Program (RLF)

This program is designed to provide GAP financing for local capital projects for which the project cannot obtain financing without the MADC RLF program.

RLF Program Details

- Minimum request if $10,000 up to a maximum of $50,000. This does not include operating expenses.

- The loan interest rate shall be 3% with loan terms as follows: machinery – 5-7 years depending on the life of the machinery and real estate has a 20 year maximum.

- Payments are due monthly on the first day of each month until fully repaid.

- Collateral acceptable to the Morrison Community Improvement Fund Committee may be required.

- Job creation or retention is encouraged, but not required.

- There is a $100 application fee payable to the MADC if the loan is approved.

- Final approval is subject to the favorable recommendation by the MCIF Review Committee and the MADC Board of Directors.

2021-08-01 Final Draft MADC RLF Application (1)

CITY OF MORRISON PROGRAMS

Historic Preservation Property Tax Assessment Freeze

This program can freeze the assessed value of a contributing property within the local historic districts that has an approved preservation ordinance. Upon certification, the property tax assessment of the real estate is frozen for a period of 8 years at the pre-renovation level, followed by a four-year period during which the property’s assessed value steps up to an amount based upon its current market value. This results in 12 years of reduced property taxes. This program is administered free of charge as a benefit to Illinois property owners interested in rehabilitating their historic properties. For more information visit http://www.illinoishistory.gov/ps/taxfreeze.htm or contact the Morrison Historic Preservation Commission at (815) 772-7657.

WHITESIDE COUNTY INCENTIVE PROGRAM

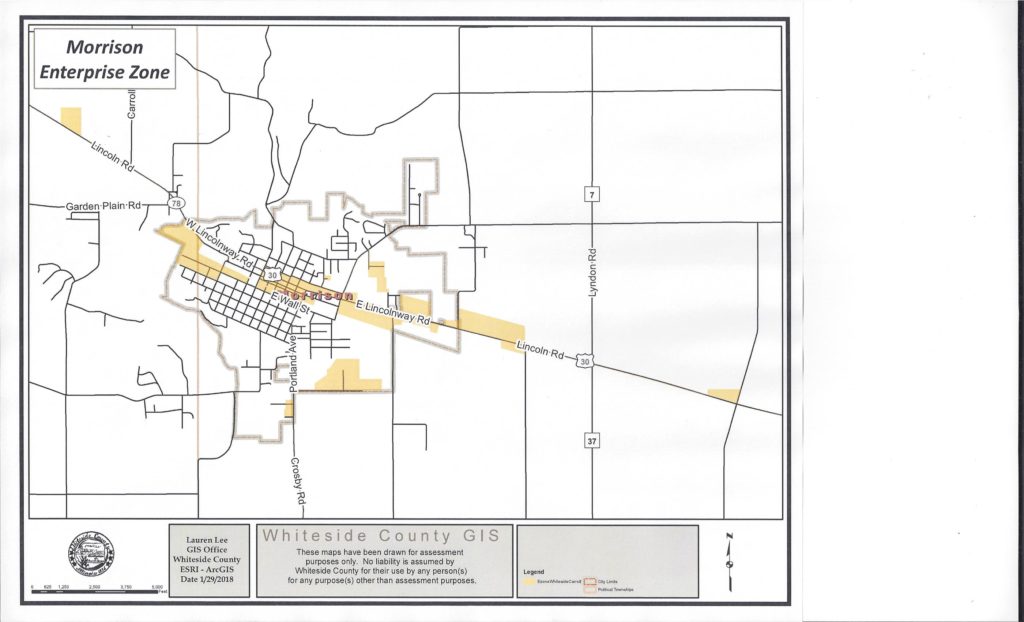

Whiteside County Enterprise Zone

Businesses considering the Morrison area can benefit from a variety of incentive programs and tax abatements by locating within the Whiteside County Enterprise Zone.

Enterprise Zone Frequently Asked Questions

Sales Tax Deduction on Building Materials

Building materials used in projects in the Enterprise Zone are exempt from sales tax with a certificate from the Enterprise Zone Administrator of the zone where the building materials will be incorporated. In the Whiteside County Enterprise Zone you must have a certificate issued by the zone administrator prior to the start of construction to qualify for any local incentives. There is a fee of .005%

Property Tax Abatement on New Improvements

Tax abatement is the exemption of all or part of the increase in the value of real property resulting from new construction or expansion of existing buildings, for a specified period of time. Improvements in the Whiteside County Enterprise Zone are eligible for real estate tax abatements as long as the property is not located in a TIF District. Abatements vary from 50% to 94% for five (5) years unless project creates 500 full-time jobs and investing at least $25,000,000 ($25M). Such projects will be eligible for a ten (10) year abatement. Percentage of abatement is determined by project location, not all taxing bodies in the zone abate. The Enterprise Zone Administrator will provide a tax abatement estimate upon request.

Investment Tax Credit

The Illinois Income Tax Act allows a .5% credit against state income tax for investments in qualified property placed in service in the Enterprise Zone. This credit is in addition to any other investment tax credit allowed under Illinois statute (consult your tax consultant).

Utility Tax Exemption/Machinery & Equipment Deduction

Businesses which make an investment in an Enterprise Zone which creates a minimum of 200 full-time equivalent jobs or retains 1,000 jobs is eligible for tax exemption on utilities. Businesses which make an investment of $5 million or more which creates at least 200 jobs or retains 2,000 or 90% of existing jobs is eligible for sales tax exemption on personal property used or consumed in the manufacturing process.

All Enterprise Zone projects must be certified by the zone administrator prior to start of construction. Building permits are required; there is an application fee.

For Questions Related to the Whiteside County Enterprise Zone Contact:

Gary Camarano

Whiteside County Development & Enterprise Zone

200 E. Knox St.

Morrison, IL 61270

Phone: (815) 772-5175

Expanding or Relocating a Business to Illinois

Expanding or relocating all or part of your business in Illinois makes a lot of sense. Illinois businesses appreciate access to key industries and a convenient and cost-effective location for growing companies. From Illinois’ first class workforce and unparalleled infrastructure to its financial assistance and abundant energy resources, relocating or expanding in Illinois can help your business become even more competitive. Why NW Illinois?

STATE OF ILLINOIS PROGRAMS

STATE OF ILLINOIS PROGRAMS

Illinois Department of Commerce & Economic Opportunity (DCEO)

Economic Development for a Growing Economy (EDGE)

The EDGE program is designed to offer a special tax incentive to encourage companies to locate or expand operations in Illinois when there is active consideration of a competing location in another State. The program can provide tax credits to qualifying companies, equal to the amount of state income taxes withheld from the salaries of employees in the newly created jobs. The non- refundable credits can be used against corporate income taxes to be paid over a period not to exceed 10 years. To qualify a company must provide documentation that attests to the fact of competition among a competing state, and agree to make an investment of at least $5 million in capital improvements and create a minimum of 25 new full time jobs in Illinois. For a company with 100 or fewer employees, the company must agree to make a capital investment of $1 million and create at least 5 new full time jobs in Illinois.

Illinois Angel Investment Tax Program

The Illinois Angel Investment Credit Program is designed to offer a tax credit to interested firms or natural person(s) who make an investment in one of Illinois’ innovative, qualified new business ventures. The investment will encourage job growth and expand capital investment in Illinois. The program can offer a tax credit to qualifying firms in an amount equal to 25% of their investment made directly in a qualified new business venture. The maximum amount of an investment that may be used as the basis for a credit under this section is $2,000,000 for each investment directly in a qualified new business venture. An awarded tax credit may not be sold or otherwise transferred to another person or entity. Businesses desiring to be registered as a qualified new business venture shall submit a registration form in each taxable year for which the business desires registration. The registration will attest to the fact that the business is principally engaged in innovation, their business headquarters is located in Illinois and their business has the potential for increasing jobs and capital investment in Illinois.

Contact Information:

Illinois Department of Commerce

& Economic Opportunity

Illinois Angel Investment Tax Program

500 East Monroe, 4th Floor

Springfield, Illinois 62701

Ph 217-557-0513

Employer Training Investment Program

The Employer Training Investment Program (ETIP) is a competitive application program for Illinois based manufactures and service companies to facilitate upgrading the skills of their workers in order to remain current in new technologies and business practices. Participation in the program will enable companies to remain competitive, expand into new markets and introduce more efficient technologies into their operations. ETIP grants may reimburse Illinois companies for up to 50 percent of the eligible cost of training their employees. Grants may be awarded to individual businesses, intermediary organizations operating multi-company training projects and original equipment manufacturers sponsoring multi-company training projects for employees of their Illinois supplier companies.

Contact Information:

Employer Training Investment Program/Incentive Program

500 E. Monroe

Springfield, IL 62701

Ph: 217/524-8145

Fax: 217/558-4860

Advantage Illinois consists of three programs to spur institutional lending to small businesses and one program to leverage private venture capital in start-ups and high-growth businesses.

Participating Loan Program (PLP)

The PLP program is designed to work through banks and other conventional lending institutions, to provide subordinated financial assistance to Illinois small businesses that employ Illinois workers. A business with 500 or fewer employees may apply for a PLP loan of not less than $10,000 nor more than $750,000. Loans shall not exceed 25% of the total project and may not be used for debt refinancing or contingency funding. Funds available through the PLP program can be used for a number of business activities, such as purchase and installation of machinery and equipment, working capital, purchase of land, construction or renovation of buildings. Funds cannot be used for debt refinancing or contingency funding. Participating lending institution shall be responsible for reviewing applications for eligibility and setting terms. Eligibility. Any for-profit small business operating in Illinois that has, including its affiliates, fewer than 500 full-time employees is eligible.

- The Standard Participation Loan Program (PLP) – designed to enable small businesses to obtain medium to long-term financing, always will be in the form of term loans, to help them grow and expand their businesses. DCEO participation is subordinated to the lender and has a “below market” interest rate.

- Minority/Women/Disabled/Veteran-Owned Businesses- similar to the Standard PLP. However, the amount of financial support may range depending on loan term, MWDV majority control/ownership. * A Minority, Women or Disabled owned business is a business which is at least 51 percent owned by one or more minority, women or disabled persons and the management and daily operations of the business are controlled by one or more of the minority, women or disabled persons who own it.

- Revolving Line of Credit (RLOC PLP)-similar to the Standard PLP except in the form of a revolving line of credit. Maximum term is two years and further support requires reapplication.

- PLP Support of Small Business Administration SBA-7A Activity- Basic structure similar to the Standard PLP. This program allows the lender to secure SBA-7A Guarantee support covering its own exposure in the overall financing. DCEO’s support is subordinated to both the lender’s and SBA’s respective positions.

The (CAP) may be accessed via participating banks. Through the program, financial institutions are encouraged to make capital financing loans to small and new businesses that do not qualify under conventional lending policies. CAP uses small amounts of public resources to generate private bank financing. Funding from a CAP can be used for many business purposes, including, but not limited to: start-up costs, working capital, business procurement, franchise fees, equipment, inventory, and the purchase, construction, renovation, or tenant improvements of an eligible place of business that is not for passive real estate investment purposes.

The (CSP) may be accessed via participating banks. It is designed to supplement loan collateral of small businesses and entrepreneurs to enhance the equity and/or loan collateral levels of these potential borrowers. The program supplies pledged collateral accounts to participating lending institutions. This program enhances the collateral of individual loans, while providing a source of deposits to lending institutions. Funding from this program can be used for many business purposes, including, but not limited to: start-up costs, working capital, business procurement, franchise fees, equipment, inventory, and the purchase, construction, renovation, or tenant improvements of an eligible place of business that is not for passive real estate investment purposes.

The (IIVF) is a venture capital program seeking to support young, innovative companies, and start-ups that show a high potential for future growth resulting in the creation of high-paying professional Illinois jobs. Applicants with a good business model and other interested investors should apply directly to DCEO.

Contact Information:

Advantage Illinois

100 W. Randolph

Suite 3-400

Chicago, IL 60601

Phone 800-252-2923

Illinois Finance Authority (IFA)

The Illinois Finance Authority (IFA) is a self-financed, state authority principally engaged in issuing taxable and tax-exempt bonds, and making and guaranteeing loans to help meet the financial needs of local government, business, healthcare, educational, cultural and social, agricultural and other entities.

Illinois State Treasurer’s Office

Invest in Illinois Programs

The Illinois State Treasurer’s Invest in Illinois programs are designed to help farmers, employers, nonprofits and residents improve their businesses or quality of life by providing them access to capital through an eligible financial institution. After an applicant is approved for a loan by one of the hundreds of eligible financial institutions in the state, Invest in Illinois programs provide a discount on the loan’s interest rate to achieve community and economic development in Illinois. Use the website to determine which Invest in Illinois program is right for you. Ag Invest is for farmers and environmentalists, Business Invest is for business owners and child care providers and Community Invest is for consumers and financial institutions. The Illinois Department of Central Management Services (CMS) http://www2.illinois.gov/CMS/BUSINESS/

Business Enterprise Program (BEP)

The Illinois Business Enterprise Program for Minorities, Females, and Persons with Disabilities (also known as MAFBE) promotes the economic development of businesses owned by minorities, females, and persons with disabilities. The Business Enterprise for Minorities, Females, and Persons with Disabilities Act is designed to encourage state agencies to purchase needed goods and services from businesses owned and controlled by members of these groups.

FEDERAL PROGRAMS

USDA Rural Development Loan Assistance

Program assistance to businesses is provided in many ways, including direct or guaranteed loans, grants, technical assistance, research and educational materials through banks, credit unions and community-managed lending pools.

Business and Cooperative Loan Assistance:

- Business and Industry Guaranteed Loan (B&I)Program

- Intermediary Relending Program (IRP)

- Biorefinery Assistance Program Biorefinery Assistance Loan Guarantees (Section 9003)

- Rural Energy for America Program Guaranteed Loan Program (REAP Loans)(Section 9007)

- Rural Economic Development Loan And Grant (REDLG)

- Rural Business Investment Program (RBIP)

Contact Information:

Princeton Area Office

USDA Service Center

312 E. Backbone Road, Suite B

Princeton, IL 61356

(815) 875-8732 ext 4

The Myth About Grants

Finally, you may have heard that there are grants to start or expand a small business. In reality, you probably are not going to find grants for your business. State and federal agencies, as well as non-profit foundations, do make grants, and some of that money may even go to businesses. However, the vast of majority of grant funding is to support projects that are expected to provide a benefit to the public. You may find some information on grants at www.grants.gov.

Morrison Financial Institutions

Advantage One Credit Union

204 N. Jackson St.

Morrison, Illinois 61270

(815) 722-7215 Ph

Community State Bank

220 E. Main St.

Morrison, Illinois 61270

(815) 722-4011 Ph

Farmers National Bank of Morrison

1100 E. Lincolnway

Morrison, IL 61270

(815) 772-3700 Ph

1st Gateway Credit Union

204 E. Main St.

Morrison, Illinois 61270

(815) 772-2200 Ph

Sterling Federal Bank

410 E. Lincolnway

Morrison, Illinois 61270

http://www.sterlingfederal.com

(815) 772-7256 Ph

TBK Bank

211 W. Main St.

Morrison, Illinois 61270

http://www.bankwithtriumph.com

(815) 772-2265 Ph

Wells Fargo Bank

100 W. Lincolnway

Morrison, Illinois 61270

(815) 772-7611 Ph